It’s a question watch collectors — especially new ones — always want answered, and one we at Fratellowatches have heard often: What brands offer watches that tend to increase in value over time? I’ll attempt to provide guidance on this, not so much from facts and figures but based on experience, and on opinions that I have heard through the years.

There are two answers here, of course, the short version and the long version. The short version is simple: Rolex and Patek Philippe.

The longer version is a bit more complicated, as there are a number of aspects that play an important role. I am not talking about the annual price increases that many brands are carrying through with, using all sorts of lame excuses. Aspects such as brand recognition, heritage, exclusivity, availability, and – perhaps the most influential of all – demand are important when it comes to the development of a watch’s value over time.

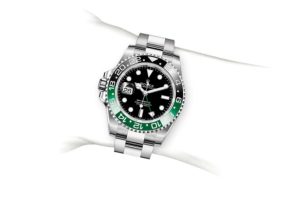

Rolex is, of course, one of those brands that is highly in demand (by both watch enthusiasts and non-watch enthusiasts); has a wonderful heritage, including an impressive list of celebrities and VIPs that wear and have worn Rolex watches; has a high level of recognition; and is widely available. It seems that the right mixture of these ingredients make most Rolex watches increase in value over time. The same is more or less true of Patek Philippe, although the accessibility of new Patek Philippe watches is more restrained due to their higher price tags compared to Rolexes. Exclusivity is the ingredient that weighs more with Patek collectors than some of the other aspects.

Aside from Rolex and Patek Philippe, luxury watch brands with a high demand (in the United States) include Breitling, Omega, Audemars Piguet, Cartier, Panerai, Jaeger-LeCoultre and IWC (in no particular order). This doesn’t mean that every watch these brands produce will automatically increase in value. We would have to look more closely into which specific models from such brands are most in demand. This is not rocket science, fortunately. Such watch models include popular classics like (for example) the Rolex Submariner, Rolex Daytona, Patek Philippe Calatrava, Omega Speedmaster, Breitling Navitimer, Panerai Luminor Marina, TAG Heuer Carrera, Patek Philippe Nautilus, Audemars Piguet Royal Oak, and so on — what a watch enthusiasts would call the usual suspects.

So, it is also a matter of buying watches at the right moment for the right price. Paying full list price for a new watch and still expecting to make a buck is difficult these days, even with a stainless-steel sports Rolex.

If you take that into account, there are a number of watch brands that will give you a decent chance on increasing your watch’s value over time. Now let’s do a rundown on a few brands that you need to keep an eye on for the long term.

The basic question is: “What brands offer watches that tend to increase in value over time?” As I wrote before, there are two answers here, a short version and a long version. The short answer is simple: Rolex and Patek Philippe. The long answer is what I try to cover in the following part of this article.

The real question is, which watches that you can buy now (that is, new watches) will become the classics or highly sought-after timepieces of tomorrow. In order to do that with a high level of certainty, you will probably — as one of our readers commented — need another 10 years to follow these watches on the market.

I always thought that the Rolex Sea-Dweller 16600 would become a classic, especially since it was followed-up by the Rolex Deepsea Sea-Dweller, a watch that had little to do with its predecessor. Now that Rolex introduced the new Sea-Dweller 116600, the true successor of their Reference 16600 Sea-Dweller watches, I am now fairly convinced that it will negatively influence the growth in value of previous Sea-Dwellers. But let’s keep Rolex (and Patek) out of this discussion, as these brands seem to be quite unique in terms of keeping value.

Another watch to keep an eye on is the Audemars Piguet Royal Oak “Jumbo,” Reference 15202, and its predecessor, Ref. 14802. In 2012, the Royal Oak “Jumbo” (or “Extra-Thin”) received an update in which the dial was changed to be closer to the original one from 1972. However, Audemars Piguet also changed the bracelet, making it a bit thicker and giving it a different clasp. While the demand for the very old Reference 5402 Royal Oak “Jumbo” remains quite high, I now notice that the pre-2012 Ref. 15202 has gotten a lot of new interest since the upgrade. It can be bought for approximately 55-60% of its list price if you look carefully. Within the last five years, the market price of this particular model has increased quite a bit and my feeling is that it still has not reached its peak.

With a bit of guesswork, and some knowledge about previous events that caused watches to go up in value, I’d suggest keeping an eye on brands that suddenly change or have recently grown in popularity. And this doesn’t necessarily mean you have to have a fat wallet. Look at Sinn, for example. When the Lemania 5100 movement went out of production, we could all see that the Sinn 142 model was bound to be discontinued (as it was, about 10 years ago). When these watches went out production, they had a price of about $1,600. Now, if you can find a nice one, you’ll have to pay just under $3,000 to get it on the the pre-owned market. The same was happening for one of its other interesting models, the Sinn EZM 1.